Part 4 : The $16 Trillion Leap

Jan 31, 2026The $16 Trillion Leap: Why the Next 17 Years Will Change Everything

In our last part, we looked at the past. But investing is about the future.

If you feel like you’ve “missed the bus” during covid high growth, the latest data from the Motilal Oswal 30th Wealth Creation Study shows that the bus hasn’t even left the station : India story is just getting started.

And this is not a political hyperbole, but backed by numers and a solid analysis. Even despite our inflation and our currency depreciation.

1. The “Power of Four”: From 4 to 16

To understand where we are going, we need to look at how far we’ve come.

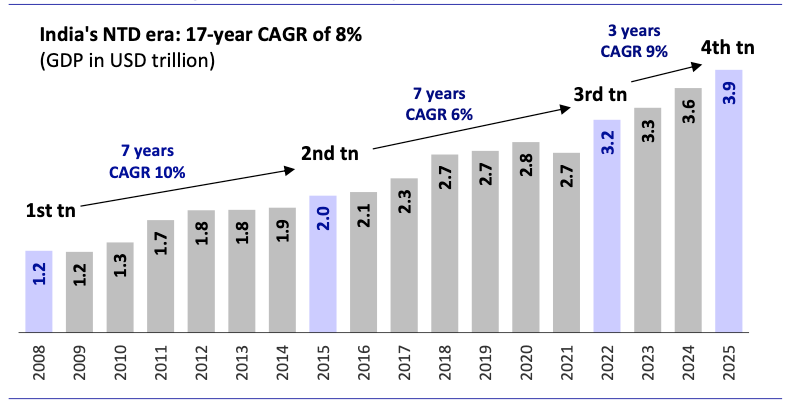

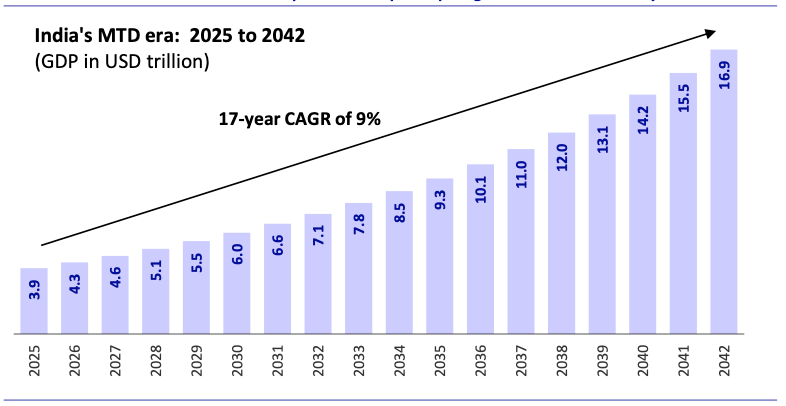

- It took India 17 years to grow from a $1 Trillion economy to a $4 Trillion economy (growing at a conservative rate of 8%)

- Here is the exciting part: Experts project that in the next 17 years, we will quadruple again to $16 Trillion. Again, by conservative growth of 8%

Why is this a big deal?

When we went from $1T to $4T, we added $3 Trillion in value.

But going from $4T to $16T means we are adding $12 Trillion in new value.

That extra $12 Trillion is like adding the entire wealth of Japan, Germany, and India *combined* into our country in less than two decades.

2. The “Wealth Effect”: Why You Can’t Sit on the Sidelines

As a country gets richer, the way people live changes. This creates a “Wealth Effect”, a very well documented impact with growth of overall wealth.

- From Saving to Investing: Historically, Indians kept money in “Dead Assets” like cash under the mattress or physical gold in a locker. Or real estate.

- The Shift: Now, millions are moving their money into “Productive Assets” : stocks. When you own a stock, you own a piece of a company that is building roads, making phones, or lending money. And taking part in India’s growth story.

- The Cycle: As the stock market rises, people feel wealthier. They spend more, which helps companies earn more, which makes the stocks go up even further. This is a “compounding cycle” that is just starting to accelerate in India.

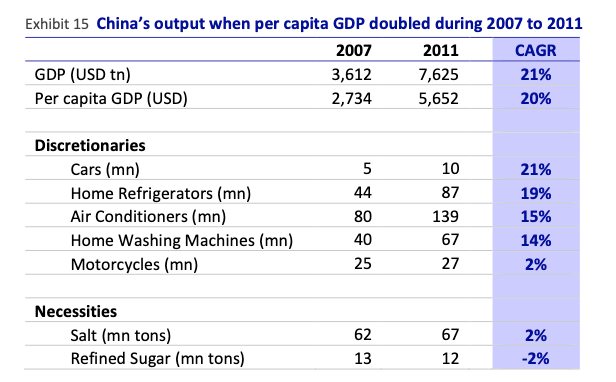

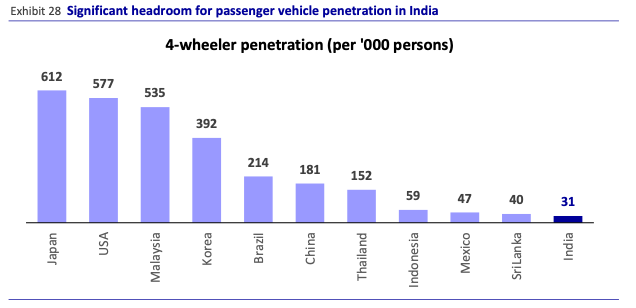

- Same thing happened in China. China’s GDP doubled from USD 2700 (India’s current level) in 2007 to USD 5,600 in 2011. What happened? The demand for Cars, Fridge, AC and other lifestyle items exploded :

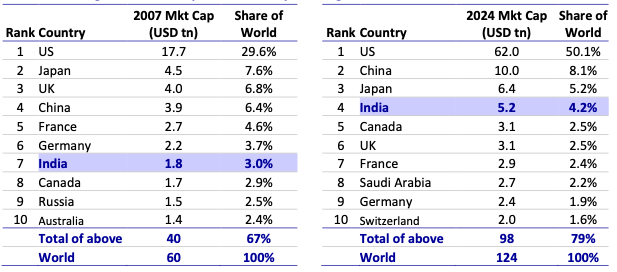

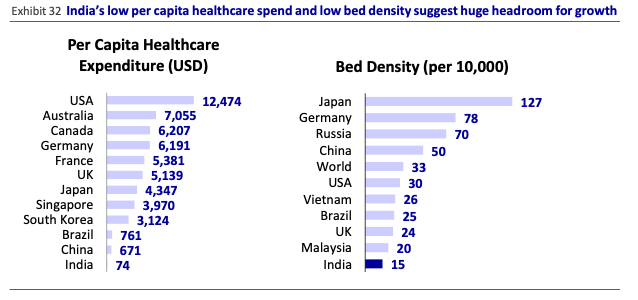

- India is now world’s 4th largest economy. But still there are so many areas where our growth is yet to happen.

3. The “Toll Booths” of the Economy (The Finance Section)

The Motilal Oswal report points out that the Finance Sector is where a massive part of this growth is happening.

Think of Banks, Stockbrokers (like Zerodha and Groww), and Insurance companies as the “Toll Booths” of the Indian economy.

- To buy a house in a $16T economy, you need a bank loan.

- To protect your family, you need insurance.

- To grow your savings, you need the stock market.

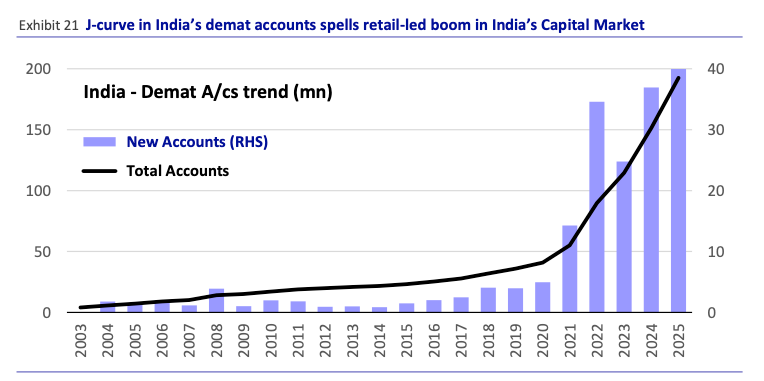

- We already see boom in India participation in stock market, the number of demat account opening is exploding

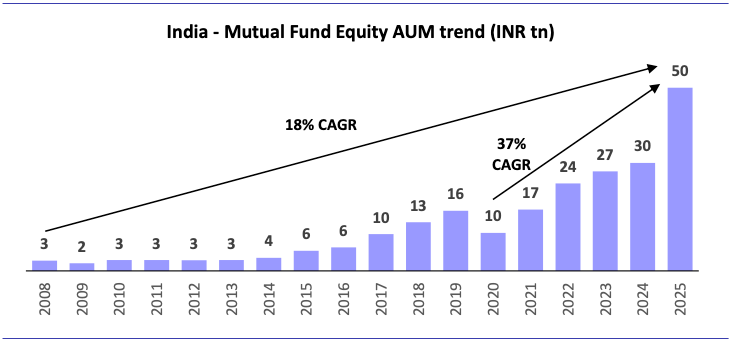

- Money going in Mutual Fund increasing at 18% Annual

4. The Final Scorecard : Your Journey Starts Now

We have traveled from the Infrastructure of our exchanges to the Players in the IPL-style market tiers. We’ve reviewed the Scorecard of historical wealth and glimpsed the $16 Trillion future that awaits.

If there is one thing to take away from this series, it’s this: India is compounding. Whether it is through stable Mega Caps or high-alpha Micro Caps, the “Toll Booths” of our economy are open for business.

Investing isn’t about timing the market; it’s about time in the market. You now have the map. You know the players. The only thing left to do is get in the game. Let’s build this wealth together!

Note : I am not a financial advisor, nor do I have anything to sell. I am simply a student of the markets, reading, learning, and sharing in public. I’ve found that thoughts only become truly clear once they are written down and shared. If you’d like to follow my journey as I build systems to filter the market and pick individual stocks, drop me a note at rsareen@gmail.com, and I’ll add you to my personal distribution list.